I lived in the United States from August 1972 to May 1977, mostly in the City of Saint Louis on a campus surrounded on the south side by Interstate 40 and the other three sides by the second-worst crime-filled ghetto in the country, whose murder rate at the time was second only to Detroit, Michigan. The campus was about a five-minute car ride to the Mighty Mississippi River, which, in the Spring of 1973, overflowed its banks threatening to flood most of the downtown area but which flooded mostly everything northeast of the city into Illinois farming country. When the disaster hit, the Nixon administration immediately sent emergency funding to the region in amounts that would today seem outrageously high, but for a state and city that was about as conservative and Republican as could ever be imagined, the National Guard was the resident savior on orders from the top.

I recall the sandbag crews up and down the river's edge shoring up the levees as citizens pitched in and stood in long lines for hours and hours as the gargantuan volume of floodwater made its way down the Gulf of Mexico, coursing its way through little towns and villages such as Festus and Ste. Genevieve and Cape Girardeau. It was a time of life in America when the welfare of the citizens was of paramount importance to politicians, unlike the events following Hurricane Katrina or Mount St. Helens, with its most recent departure being the wildfires in Lahaina, Hawaii.

As a non-American, I have little or no right to be critical of her policies, but as I carry the fondest of memories of my time and friendships with many citizens of the U.S. Midwest, it pains me greatly to watch billions of dollars float aimlessly into Ukraine while 7,696 miles away in the State of Hawaii, entire cities have been incinerated by wildfires fanned by winds of a neighboring hurricane. In a case where priorities have gone catastrophically awry, the optics of being "soft on the Russians" takes priority over being seen as "soft on human tragedy."

Perhaps it is unfair to center out the Americans for what appears to be a misalignment of priorities, but it seems to this rather embittered veteran of a thousand skirmishes — with a myriad of real and imagined foes over the years — that the earth (or rather mankind) has tilted slightly askew of its normal rotation around an axis that has served it well over the millennia.

Politicians the world over would rather kiss babies than heave sandbags as the path of least resistance for the political creature has become the path of greatest popularity. Staying out of the trouble caused by taking a particularly controversial stance on race or immigration, or abortion has become the preferred strategy of anyone running for office, and now that social media is the medium of choice for policy distribution, the delivery mechanism is run by a team of "quants" (quantitative analysts or "numbers crunchers") that will tinker with the words and sound bytes until the desired number of "likes" hits an optimal number.

The acceptability of the message has replaced the integrity of the message in political strategy sessions the world over, and nowhere is this seen so clearly than in the current debate over the opposing forces of fiscal and monetary policies.

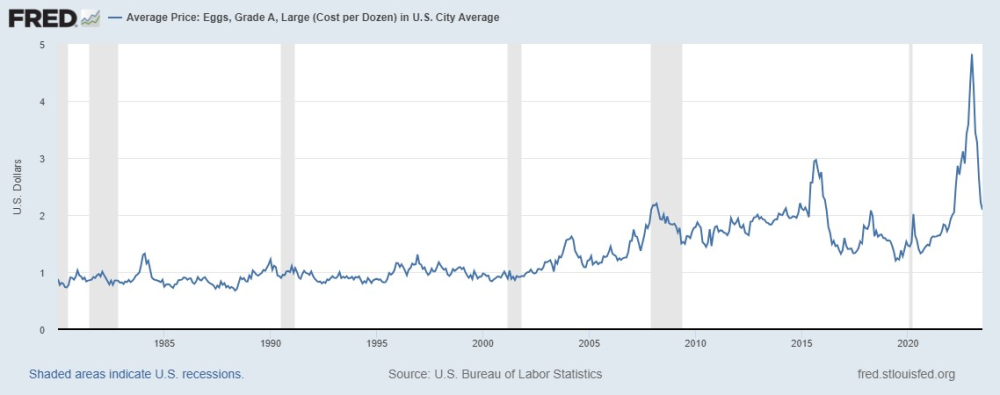

In the U.S., the Talking Heads on CNBC have been applauding the steady cooling of the rate of inflation and once again pointing to the "brilliance" of the Fed in orchestrating a "soft landing" for the economy thanks to the sharpest and fastest jump in borrowing costs in history. Stocks have risen for five consecutive months as the re-emergence of "happy times" dominates the current MSM narrative but as happy as the Wall Street titans are once again showing, the average citizen looks at the 3% published rate of price increases and blinks while looking at the price of eggs still up 50% in the last three years. Gone are the "supply shocks" brought on by the pandemic three years ago, and gone is the 8% CPI reported last year, but eggs are still ridiculously expensive.

Egg Prices

Politicians and central bankers feed the narrative to the mainstream media about "victory over inflation!" but the decline in the rate of price increases is not the same as changes in the price itself.

Prices in 2023 versus prices in 2019 are still dangerously high, and the citizenry is only now beginning to see these banker-politician "victory laps" as being disingenuous at best and downright fraudulent at worst.

Just as fending off the Russian bear in Ukraine is now falling to the second and third pages of the NY Times, this alleged "soft landing" being promoted by the Wall Street spin doctors is not as broadly accepted by the masses these days as they might have preferred. If the stock market advance is signaling that "Happy Days are Here Again!", why is it that the SLOOS report of banker lending intentions is indicating a sharp and very predictive spike in lending requirements which spells less money available for only the safest of borrowers — meaning — that the less-affluent will either be unable to secure a loan or they will pay an exorbitant rate of interest if approved.

Back in the 1980's Tony Boeckh wrote a superb letter called "The Bank Credit Analyst" that used the actions and intentions of the bankers as a predictive model for interest rates, stocks, bonds, and commodities. It operated on the premise that since the entire 1980s economy was anchored in debt, the price of that debt was the ultimate driver (or non-driver) of growth.

Here in 2023, with the amount of debt absolutely dwarfing the levels seen in 1980, the price of credit takes on new meaning when one considers that interest payments on the US$33 trillion owed by the U.S. exceeds the amount of tax revenues it collects. If one of these bankers polled by the SLOOS people at the Fed were to sit down with a government official and assess the creditworthiness of the U.S. government, he would be unable to extend loan facilities of any size, shape, or term. Yet, when discussing the role of the Yankee greenback as the rightful owner of the role of reserve currency of the world, the Wall Street and Washington narrative creators totally ignore the facts surrounding the fiscal solvency of the nation.

So, when the BRICS meet on August 17 to discuss a means of transacting international trade away from the U.S.-dominated currency exchange mechanism, the primary point of discussion should dovetail back to the safety of one's principal. If the Saudis sell a barrel of oil, they might prefer that the medium of exchange retain its purchasing power over time, and with unserviceable debt plaguing the U.S. dollar, there is little if any security in that happening.

The gold bugs would point to an oil-for-gold arrangement where all international oil settlements be made in a gold-backed unit of exchange, and they would not be wrong in getting agitated over such an event. My only question on the topic of the BRICS meeting is whether or not an arrangement like the one just described would affect gold demand or whether central banks could simply collateralize their country's payments with their audited gold reserves. For the Western nations, they would be forced to have an independent audit of their gold reserves which would once and for all satisfy the conspiracy theorists that question the American claim on 8,133 metric tonnes of gold as their reserve number.

At the end of the day, it is the debt monster that threatens to choke off all economic activity as the burden of servicing the debt replaces line items such as military spending, infrastructure refurbishment, education, and health care.

We all know the percentage of gross domestic product attributable to government spending, but that spending is deducted from GDP if it is allocated by force and necessity to interest payments.

This is what I believe is spooking the long end of the U.S. bond market to a far greater degree than inflation or Fed jawboning.

The return OF principal rather than the return ON principal is of greater concern to lenders in the same manner that the SLOOS report has today cast judgment on the creditworthiness of the average borrower.

It seems that the chickens have finally come home to roost on the American banking brethren.

Nvidia

Speaking of chickens coming home to roost, the chart of Nvidia (NVDA:NASDAQ) is beginning to look like the NASDAQ circa 2001 as it is now firmly in correction mode with RSI crashing toward oversold status and both MACD and MFI working "sell signals."

It broke the uptrend line two days ago on a line drawn off the January lows around US$150. Note the big gap created in late-May when the Stanley Druckenmullers of the world announced that "AI" was going to redefine our lives and absolutely HAD to be in every portfolio on the planet led by, of course, NVDA! The gap between US$300 and US$360 is ominous and insofar as technical analysts live by the rule that says "all gaps must get filled", that is a long way from the current level of US$411 (and down from the 52-week high at US$480.88).

As NVDA goes, so goes the market, with great deference to past eras when the same could be said of General Motors and International Business Machines.

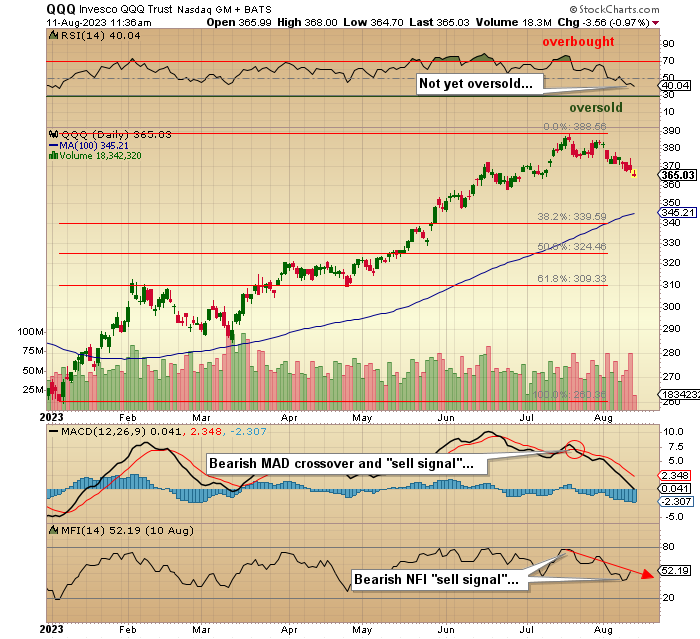

Invesco QQQ Trust

I am short the Invesco QQQ ETF (QQQ:NASDAQ) since late-June and after getting smoked on some July put options, I quickly re-established the short on the Monday following the July 21 expiry, so with the QQQ finally breaking trend along with NVDA:US, it looks like it is now headed to a zone between the 38.2% Fibonacci retracement level at US$3.39 and the 100-dma at US$345.

At that level, I recoup the July hit and take a double out of what should have been a quadruple, had I started out with the September series instead of the July's.

I see trouble "on the rise" (as CCR would sing back in the late ‘60s) and I sense that stocks are sniffing it out as well. Rallies are getting sold and dips ignored which is a direct contrast to the state of the markets from March-July when "AI" was king instead of the court jester it has since become.

Energy, Gold, and Silver

The energy trade that I put on in late May has evolved into one of my best in years. The last time I went long oil was in April 2020 after the Crimex futures had a minus US$37 settlement price. The next morning amidst great ridicule from my competitors I went long and got laughed at until the price hit US$100/bbl. thanks (or no thanks) to Vlad the Impaler's invasion of the Ukraine. The Energy Select Sector SPDR Fund (XLE:NYSEARC) trade was put on at around US$77 and today printed almost US$90 for a 17% return in three months. I exited the calls around the same time I got antsy about the stock market so while I was early, they were a double so they did their job.

Gold and silver are languishing mightily and I refuse to take even a token position until after the August 17 BRICS conference. The reason is that there has been so much bullish narrative dumped on this meeting by the gold newsletter community that I wonder what happens if "nothing" happens. I see an avalanche of capitulatory liquidation taking gold down into the US$1,900-1,920 zone or US$174-176 on the SPDR Gold Shares ETF (GLD:NYSE).

As for silver, my remarks remain the same as always. I will let price and price alone govern my actions as the dismal action this month in silver has already validated my aversion to joining those with major margin calls to meet after the "US$25 BREAKOUT!!!" turned into a false breakout (as always) and cheers turned to tears in the rubble of net worth ashes. That said, I own physical silver and continue to target sub US$20 as a level at which to add more of these beautiful 100-ounce bars that adorn the second shelf of my safe with pride and audacity.

Volt Lithium

I have commented extensively about a company that I own that has developed a cheap method of extracting lithium from oilfield brines while purifying the brines for safe return to the subsurface aquifer. The company is Volt Lithium Corp. (VLT:TSV;VLTLF:US) and has been the poster child for babies being thrown out with the bathwater as the junior resource sector has been pummelled by poor sentiment and non-existent liquidity.

I want to repeat a note I sent to subscribers yesterday as a final summation of the mindset of the junior resource investor these days:

"I was in discussion this morning with a large shareholder (1 million + position in VLT:TSXV) that is arguably one of the best traders I have ever known, having run the Canadian trading desk for one of the big U.S. brokers in the 1990s. We were discussing the juniors with particular attention to Volt (which was the reason for his call) and how impressed he was that they closed the US$6.9m financing in the middle of one of the world's summer markets for junior resource deals in (his) recent memory. This colleague of mine never loses money, and after I was griping about the absurdity of investors "not trusting" their DLE process despite the credibility of sign-offs by world-renown Sproule Inc. and IIROC (Canada's securities cop). In his (and my) opinion, all Volt needs to do is execute, and we will all cash a very large ticket within the next year as they process the 1,000 tonnes of lithium.

Having just received my certificate from the Volt financing, I told my colleague that I was going to bid for another 100,000 shares but that my only misgiving was that it could be "dead money" until the junior resource market perks up. His reply: "If they execute, it won't matter a damn bit what the junior market is doing; Volt will BE the junior resource market."

I fully concur with his assessment. The upcoming PEA will spell it out in spades, but some government grant money and a deal with another oil producer would be icing on the cake, both of which are entirely possible. This is the kind of stock where you wake up one morning, and it is US$1.50 bid for no apparent reason other than someone with deep pockets suddenly "getting it."

My colleague is CA$.18 bid for the first 100k with plenty more behind that. I am thinking along the same lines. . .

You can take that type of discussion and apply it to any number of the quality juniors out there, and there are dozens of high-end developers that are sitting on respectable resources with great management teams suffering from share prices that are trading at shell pricing levels. When crisis-like valuations for the juniors gets this absurdly low, opportunities abound.

The first time I ever saw the Chinese symbol for the English word "crisis," I was confused because it was comprised of two symbols, the first "danger" and the second "opportunity."

Such is today's "crisis" in the junior resource sector.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of:Volt Lithium Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.